direct vs indirect cash flow forecasting

Reason being that the direct method provides information which may be useful in estimating future cash flows of an entity which helps the users in their decision making for eg for estimating the market value of an entity for estimating the future liquidity position etc. Indirect cash flow forecasting.

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

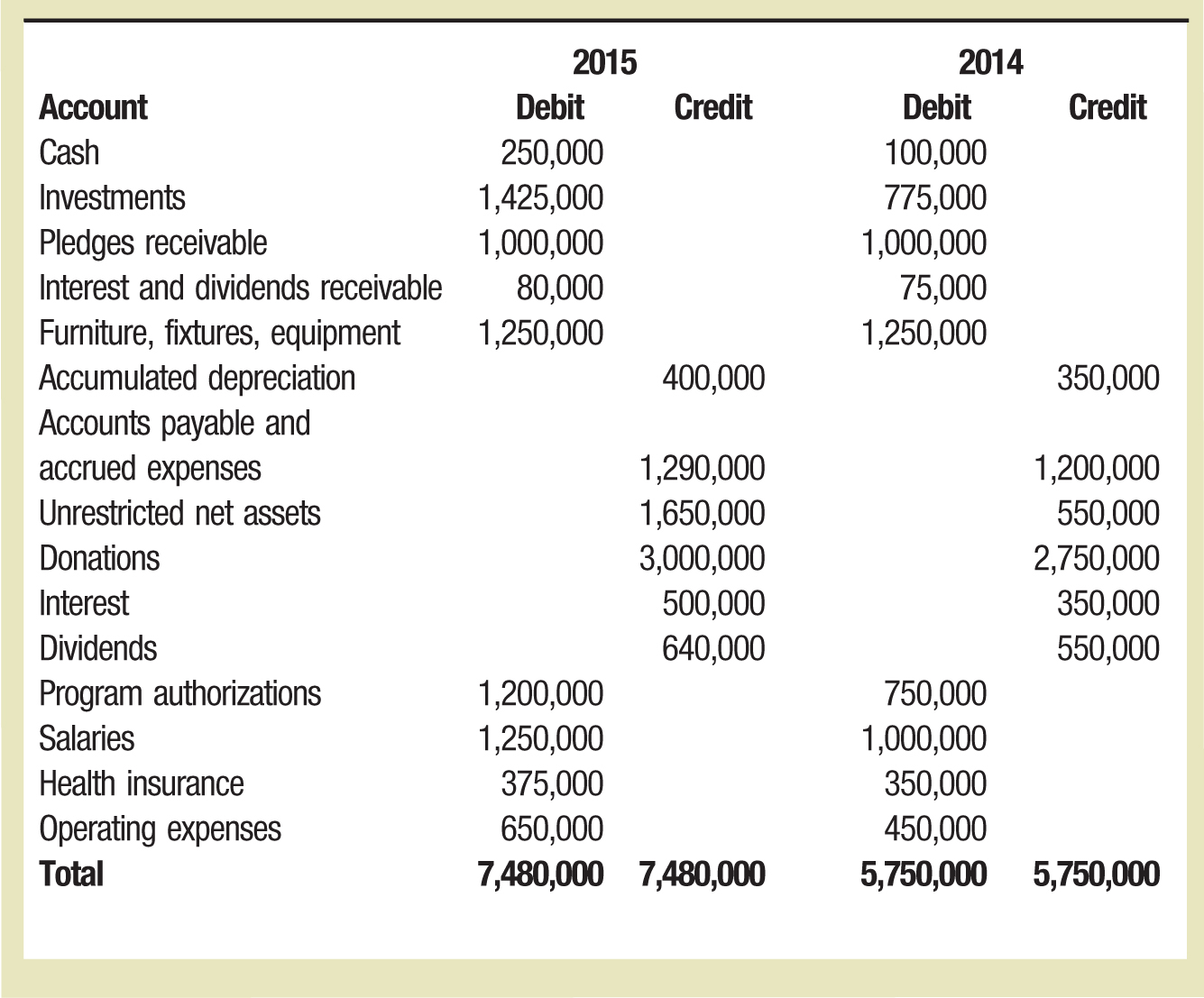

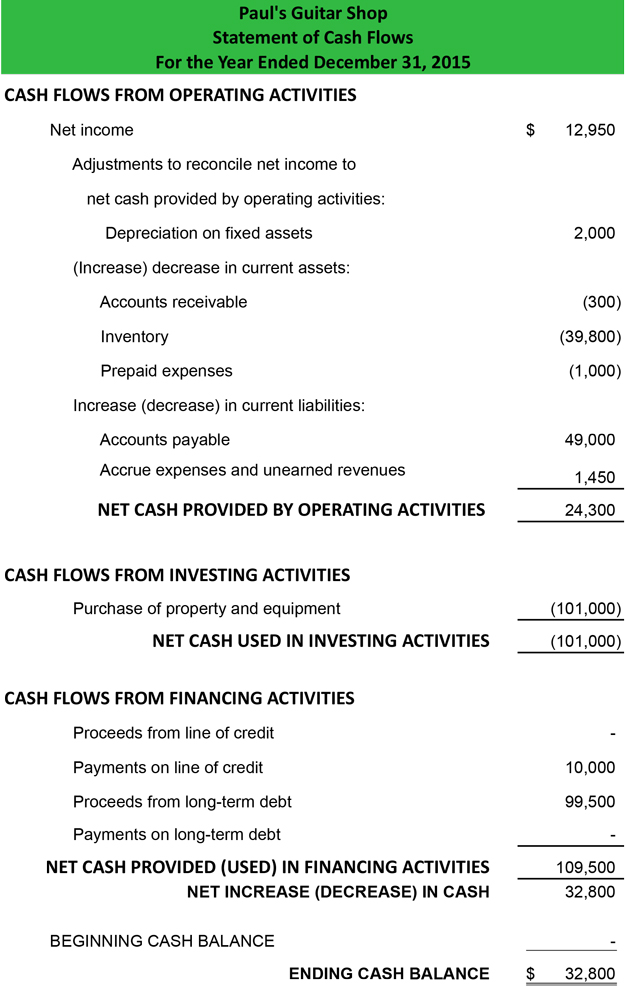

The main difference between the direct method and the indirect method of preparing cash flow statements involves the cash flows from operating expenses.

. The main difference between the two methods relates to the cash flows from the operating activities. You can perform a cash flow forecasting using either the direct or indirect method. Moreover each business is different and may prefer a certain way.

Ad Forecast your future cash position and gain your control on your business finances. Direct Cost Vs Indirect Cost. This is because it uses adjustments where the direct method does not.

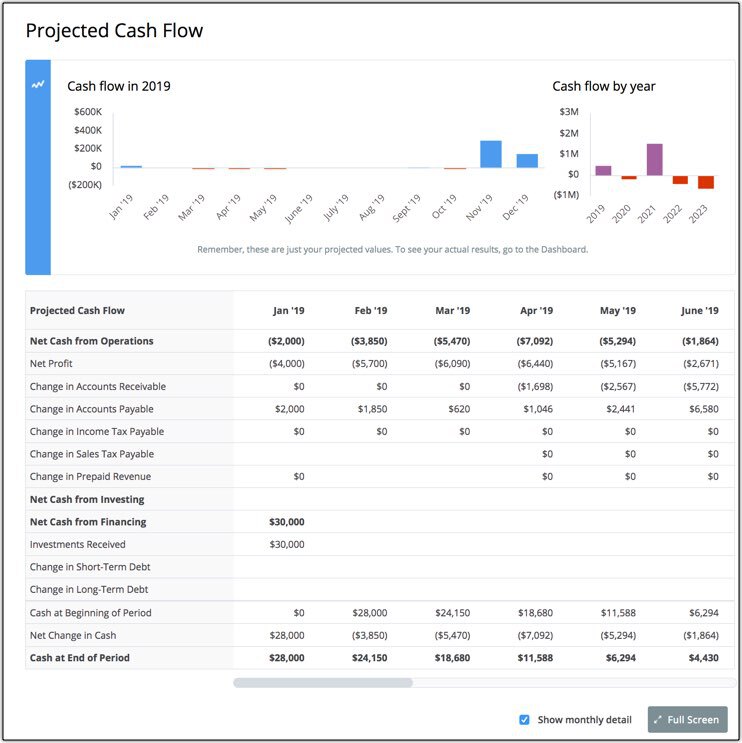

The two main cash flow forecasting methods are direct and indirect. Eventually youll need to switch to indirect cash flow forecasting as your company expands. Direct cash flow forecasting uses cash data such as receipts invoices and taxes paid to calculate cash flow over a certain period.

When considering direct vs indirect cash flow preparation ways all you would report with the first one is cash receipts and cash payments from operating activities. Whereas the direct method will only focus on the cash transactions and produces the flow from the operations of your business. Comparing the Direct and Indirect Cash Flow Methods.

The difference between these methods lies in the presentation of information within the cash flows from operating activities section of the statement. Direct cash flow forecasting. Eventually they switch to indirect cash flow forecasting as the company expands or plans for acquisitions.

Generally there are two categories of cash flow forecasting techniques. Direct cash flow forecasting. The direct method and the indirect method are alternative ways to present information in an organizations statement of cash flows.

Generally companies start with direct cash flow forecasting to understand their daily cash movements. Key Differences Between Direct Vs Indirect Cash Flow Methods. A business might use direct cash flow forecasting at the beginning of a month for example to make sure that it will have enough working capital to pay end-of-month bills.

It is a simple way of calculating your cash flow and can be done quickly from data readily available in your accounting software. Indirect cash flow forecasting. Direct cash flow forecasting.

How To Prepare A Statement Of Cash Flows. Rated the 1 Accounting Solution. Ability to draw prompt conclusions.

There are at least a few advantages to it including. Thats primarily because it provides a clearer picture of cash inflows and outflows. The indirect method is often easier to use than the direct Direct vs.

Ability to show the main sources of inflow and directions of cash outflow. In the case of an indirect cash flow method changes in assets and liabilities accounts are adjusted in the net income to replicate cash flows from. There are no presentation.

Under the direct method you present the cash flow from operating activities as actual cash outflows and inflows on a cash basis without beginning from net income on an accrued basis. The cash flow methods affect just the cash flow from the operating activities while the cash flow from the investment and financing sections remain the same under both methods. Which Cash Flow Method Is Better.

Cash flow forecasting is a way to learn where a company stands in terms of its financial position by keeping track of the finances and predicting where a company is heading. As a rule companies start out with direct cash flow forecasting to get an idea of daily movements. Cash flow forecasting is a way to learn where a company stands in terms of its financial position by keeping track of the finances of a company and predicts where a company is heading.

Generally speaking the indirect method is easier to use. In fact its the only feasible way of producing a cashflow forecast manually its too difficult to model any volume transactions by hand so in the past most finance people have relied on the indirect method. Direct Cash Flow Forecasting Zeroes In On The Ground Game.

Cash flow forecasting is a core part of financial planning and assists with the day-to-day management of a business. If you run a toy store the purchase of the toys is a direct cost. This is an essential part of measuring day-to-day cash flows and knowing whether to buyborrow investment opportunities.

This helps them to identify borrowing or investment opportunities. Changes in asset and liability accounts that are capable of affecting your cash balances in a defined reporting period are added or subtracted from your net income at the beginning of. Allocable as a cost that has a direct benefit and is directly attributable to the project being performed.

Test multiple scenarios generate accurate forecasts and enforce your chart of accounts. Such information is not available under the indirect method. Generally there are two categories of cash flow forecasting techniques.

Regardless of whether the direct or indirect method is used confidence in cash flow forecasts can help business leaders make more informed decisions regarding how to spend and conserve a companys cash. Ad QuickBooks Financial Software. Reporting The primary distinction between the direct and indirect cash flow statements is that operating activities generally report cash payments and cash receipts occurring.

Indirect cash flow forecasting. Its also important to note that the accuracy of the indirect method is slightly less than the direct method. However youll still need to reconcile your cash flow to the balance sheet.

The case for the direct method cash flow is that the Financial Accounting Standards Board recommends it. Closing balance of fixed assets plus depreciation minus opening balance. The indirect method of creating a statement of cash flow entails using changes in your balance sheet accounts to calculate cash flow from operating activities.

Direct forecasting deals with known costs and this method is generally appropriate for short-term forecasting. In the case of direct cash flow methods changes in cash payments are reported in cash flows from the operating activities section. The direct method ideal for shorter periods identifies all likely future inflows and outflows.

Indirect cash flow forecasting uses information from projected balance sheets and income statements to predict cash flow. As you are simply making a few adjustments to one figure you can arrive at your final figure much quicker than the direct method. The indirect method which is best for longer terms uses.

The indirect method is widely used by many businesses. So if the direct method is so accurate why would you use the indirect method.

Direct Vs Indirect Cash Flow Statement Excel Model 365 Financial Analyst

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Example Direct Method Of Cash Flow Statement Financiopedia

Ias 7 Statement Of Cash Flow Summary Video Lecture Acca Online Accounting Teacher Cash Flow Positive Cash Flow Cash

Free Cash Flow Statement Templates Smartsheet Cash Flow Statement Spreadsheet Template Cash Flow

Differences Between Direct And Indirect Cash Forecasting Cashanalytics

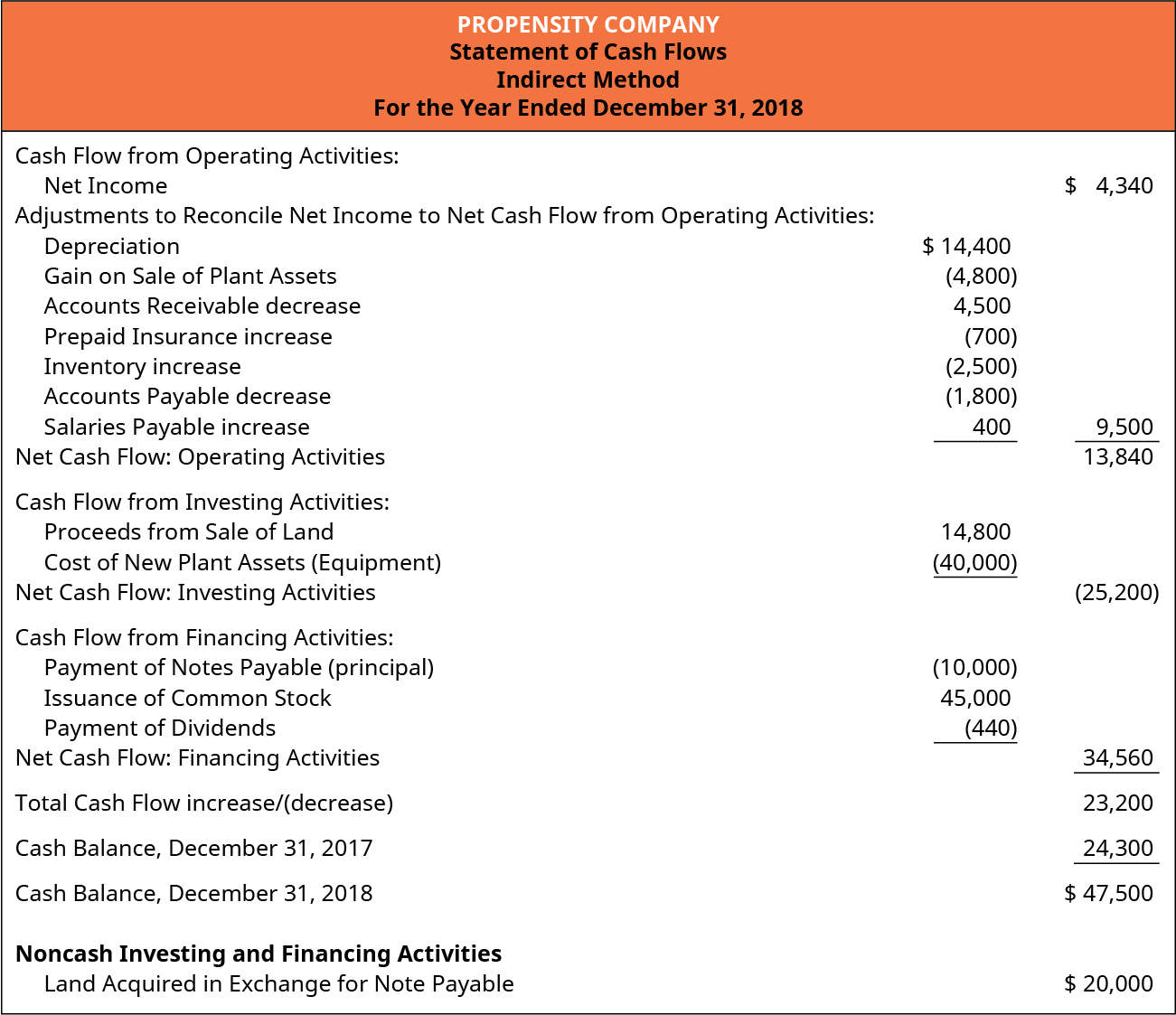

Statement Of Cash Flows Indirect Method Format Example Preparation

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal

Statement Of Cash Flows Significant Non Cash Activities Bookkeeping Business Cash Flow Statement Accounting Classes

Direct And Indirect Cash Flow Statement Comparison Cash Flow Statement Cash Flow Positive Cash Flow

Prepare The Statement Of Cash Flows Using The Indirect Method Principles Of Accounting Volume 1 Financial Accounting

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Direct Indirect Method Of Cash Flow Forecasting Float

Preparing The Statement Of Cash Flows Using The Direct Method The Cpa Journal